Last week, Switzerland’s top criminal court delivered a landmark verdict in the country’s first criminal trial against a major lender. The bank was found guilty of having failed to prevent money laundering, allowing an international drug trafficking network to move more than 19 million Swiss francs through its accounts [i]. The case has garnered considerable attention in Switzerland, perceived as heralding a toughened stance on financial institutions found to be deficient in their compliance regimes. Indeed, there may soon be another criminal prosecution waiting on the docket [ii] – and Swiss courts may not be the only ones witnessing the shift. Recent years have seen the advent of several high-profile criminal prosecutions against banks across Europe, prompting speculation as to whether regulators will increasingly seek to flex their proverbial, prosecutorial muscle.

Over the past decades, the banking sector (and other obliged entities) has become accustomed to ever-increasing administrative fines for technical non-compliance. This includes, for example, KYC shortcomings; incomplete sanction screenings; and/or inadequate risk scoring, to name but a few. Seven-figure fines certainly reflect the seriousness with which regulators view such breaches and can damage both revenues and reputations – but where evidence of actual money laundering is lacking, notions of resulting societal harm may remain hypothetical. Conversely, recent criminal investigations have revealed instances where AML risks have in fact crystallised because of weakened organisational controls. In such cases, the link to actual abuse of client accounts as vehicles for money laundering is tangible – and the institutions involved have received criminal convictions, fines, or both.

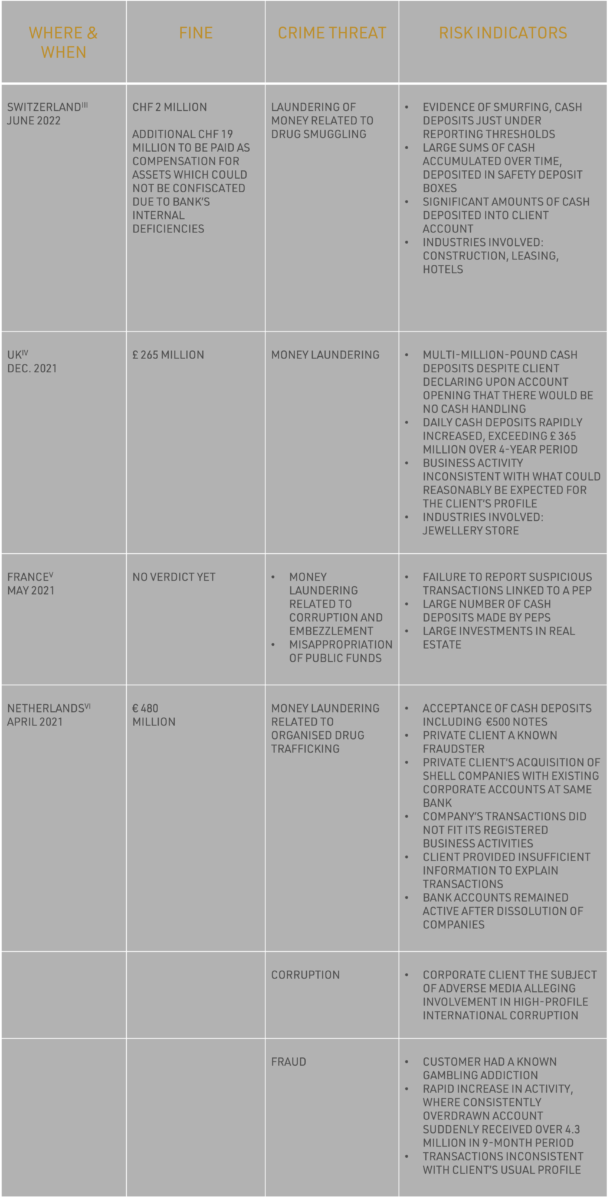

In the table below, we summarise several recent criminal cases against banks in Europe. Whether they settled or made it to court, each of the cases involved transactions bearing the hallmarks of money laundering and other financial crime, which authorities said should have been identified and swiftly reported. While this is just a small selection of cases, with differing facts and circumstances, they serve as a reminder to financial institutions to be alert to the very real crime threats, they face, and to recognise risk indicators when they arise.

Each of the cases above revealed a constellation of risk indicators, the identification of which was critical to compliance. As was highlighted by the Court on one occasion, while the bank in question “was in no way complicit in the money laundering which took place, the Bank was functionally vital. Without the Bank – and without the Bank’s failures – the money could not be effectively laundered.”[vii]

We at Acuminor are of course cognizant of the difficulties organisations face in wrangling disparate and ever-evolving information regarding financial crime (indeed, a reality which serves as our raison d’être !). There can be no doubt, however, that an appreciation of the threat landscape and associated risk indicators is essential for regulated entities seeking to protect themselves and society from financial crime.

Stephanie Ygoa and Mara Wesseling – Intelligence at Acuminor

[i] Federal Criminal Court of Switzerland, (2022) Cause Ministère public de la Confédération contre Credit Suisse AG et autres prévenus (SK.2020.62), 27 June 2022, Communiqués aux medias (bstger.ch)

(ii) SWI swissinfo.ch . (2022, June 16). Swiss Prosecutor Sees Millions Laundered Via Credit Suisse. Swiss Broadcasting Corporation. https://www.swissinfo.ch/eng/bloomberg/swiss-prosecutor-sees-millions-laundered-viacreditsuisse/47678760

[iii] Ibid.

[iv] R v National Westminster Bank PLC, Southwark Crown Court, Sentencing Remarks of Mrs Justice Cockerill, 13 December 2021. https://www.judiciary.uk/judgments/r-v-national-westminster-bank/ . See also R v National Westminster Bank PLC, Agreed Statement of Facts.

[v] Sebag, G. (20 May 2021) BNP charged for ill-gotten assets linked to Gabon, Bloomberg, BNP Charged for Laundering Ill-Gotten Assets Linked to Gabon – Bloomberg

[vi] NPPS. (2021, April 19). Statement of Facts and Conclusions of the Netherlands Public Prosecution Service. National Office for Serious Fraud, Environmental Crime and Asset Confiscation and National Office. https://assets.ctfassets.net/1u811bvgvthc/4eUXF7eCnLthKp95RNnMnz/645730a7cd044da33ef4ad1545470f12/Statement_of_Facts_-_ABN_AMRO_Guardian.pdf

[vii] R v National Westminster Bank PLC, Southwark Crown Court, Sentencing Remarks of Mrs Justice Cockerill, 13 December 2021. https://www.judiciary.uk/judgments/r-v-national-westminster-bank/ . See also R v National Westminster Bank PLC, Agreed Statement of Facts.