large volume of alerts

Existing transaction monitoring scenarios create thousands of alerts every month. All alerts have to be dealt with, which takes a lot of time and drive up costs.

Reduce number of alerts and false positives by up to 90% in your existing transaction monitoring solution by deploying an intelligence-led approach

Existing transaction monitoring scenarios create thousands of alerts every month. All alerts have to be dealt with, which takes a lot of time and drive up costs.

Out of all the alerts generated, it's common to see that more than 99% are false positives. This creates frustration amongst staff and senior stakeholders.

Common practice has been to rely on general scenarios and adjusting thresholds to reduce number of alerts. This makes it hard to evidence that scenarios are actually mitigating the highest risks across the organisation.

Replacing a transaction monitoring platform can be extremely costly, and sometimes not even possible. This means you often have to make the most of what you have.

Easily identify how effective your current transaction monitoring is and get detailed insights in how to optimize it.

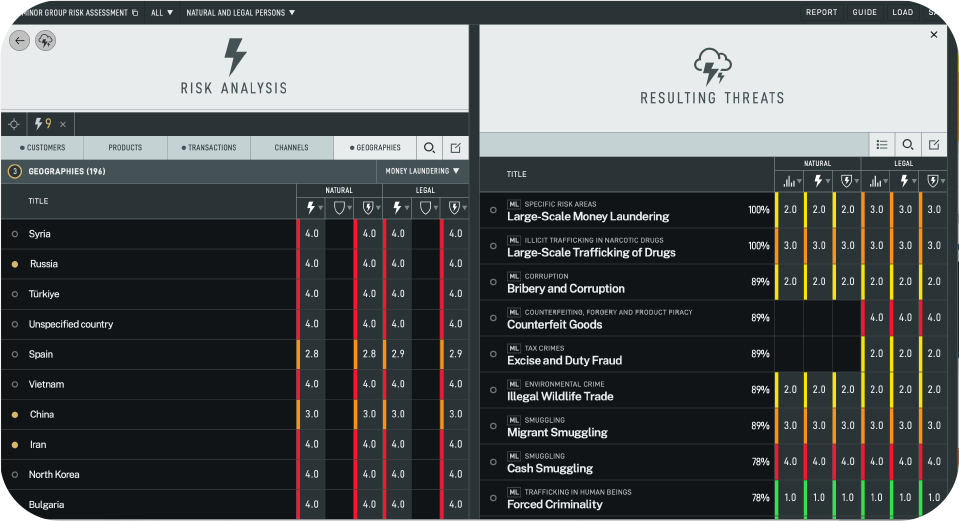

Identify the highest threats and risks across the organization using external and internal intelligence

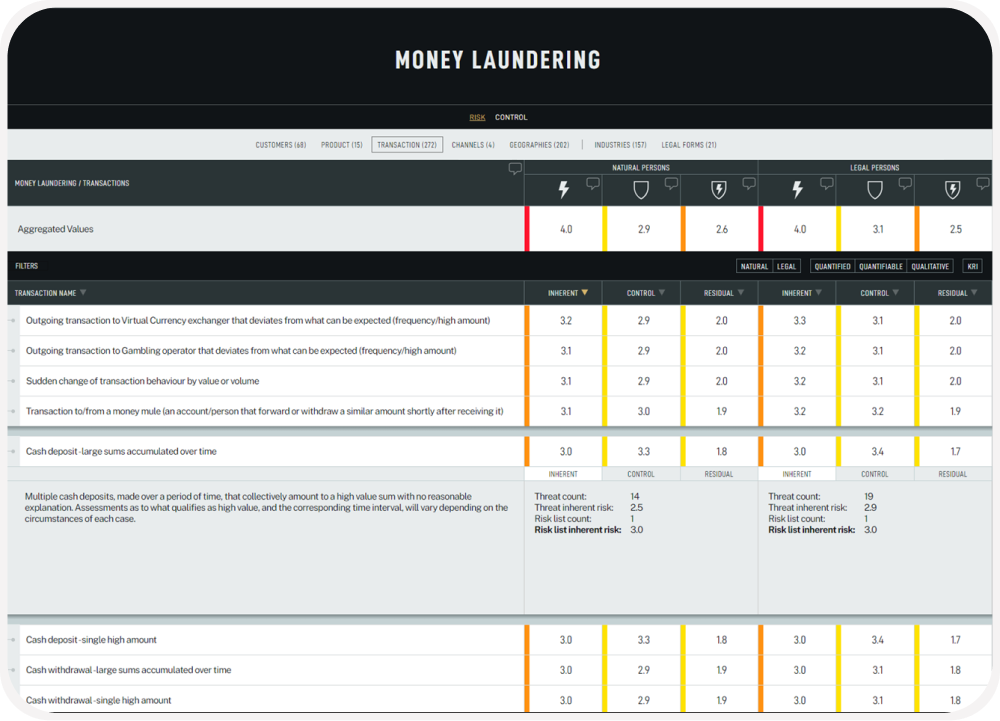

Define and document all current transaction monitoring capabilities and connect them to relevant risks

Get detailed, accurate information of risk coverage, performance and potential improvements needed

Effectively manage existing and emerging threats and risks without having to replace your existing transaction monitoring platform.

Details of all threats, risks and scenarios stored in one place, using the same language and taxonomy

Combine global and local intelligence with data to automatically drive insights on performance, on a group level as well as locally

Get detailed understanding of what scenarios to change, remove or implement

Accelerate investigation processes without compromising on quality. Our unified intelligence platform provides investigators with a structured methodology, ensuring consistency across all investigations while reducing the time spent on each case.

Empower your investigators with real-time threat and risk intelligence, allowing them to make informed decisions quickly and confidently.

Benefit from centralized governance that prioritizes key threats and risks, and clearly defines the criteria required to file a SAR or close an investigation, ensuring compliance and thoroughness in every case.

Never let data gaps hold you back—our intelligence-driven approach offers a comprehensive view, enabling more effective and efficient investigations.

Create a feedback loop to communicate emerging risks and key findings with central risk teams, product risk teams and others.

Harmonized taxonomy and risk ratings makes it easy to focus on the same threats and risks across the organization.

Helps the organization identify and mitigate risks early, before they can translate into transaction monitoring alerts.

Contribute to the strategic risk picture with your own internal findings and expertise.