This week our weekly round-up is replaced with an article about over-the-counter broker, in order to highlight and raise awareness around cybercrime and the cybersecurity awareness month.

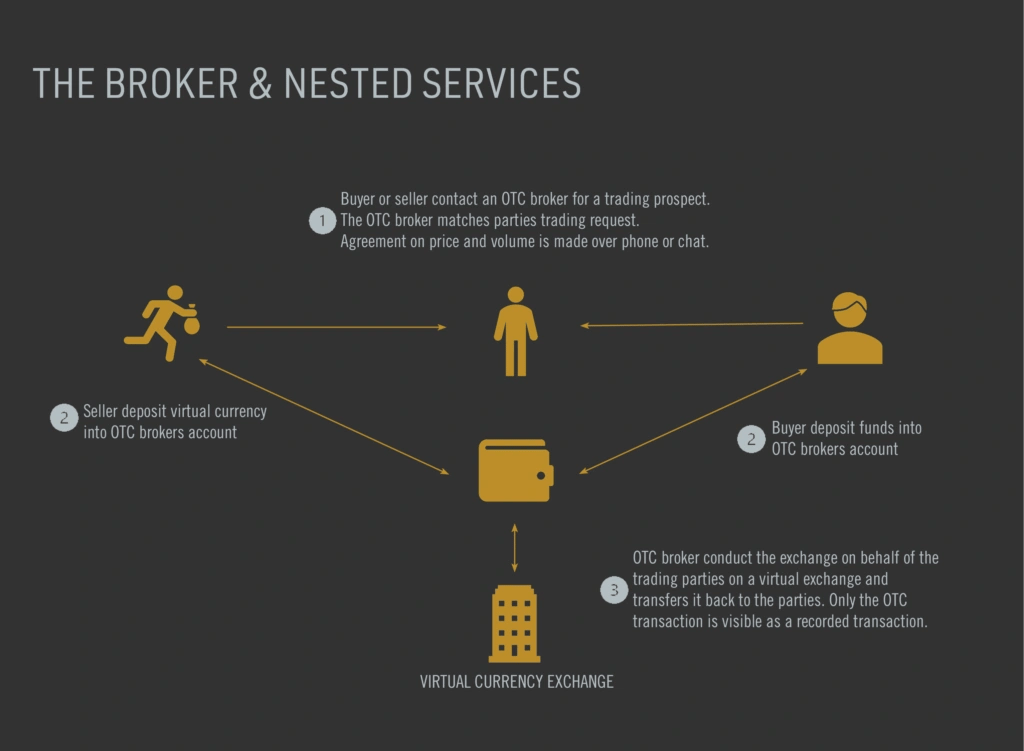

An Over-The-Counter (OTC) broker is a company or individual that help to facilitate private transactions between two parties that want to trade with virtual currencies, in a higher volume and with more anonymity. The reason for the anonymity is to protect from market influence due to large trades. The OTC broker can be part of a virtual currency exchange or be connected to a public trading platform to access the liquidity needed for possible exchanges and lower prices, a so-called nested exchange.

The OTC trading is conducted outside of the public trading room with separate order books. The trade is managed through phone or chat channels between the trading parties. The trade is conducted privately, directly between the two parties, thus not recorded as a transaction passing through an exchange. The OTC broker acts as a middleman that each party send their respective funds before a trade is settled. When the OTC broker has received the funds from both parties, they are released to the buyer and seller. The OTC broker can also assist in further conversions of currencies or cashouts.

What is significant with OTC trading is that it is always of higher volumes (i.e. minimum of $10 000 – $100 000 to initiate a trade prospect). It is also possible to be more anonymous and withdraw cash directly over the counter in many places. Cybercriminals are increasingly using OTC brokers to facilitate money laundering. In that case, the explicit or implicit broker is an active part of the laundering process. Besides trading in higher volumes, settlements are not as visible as conventional virtual currency exchanges when using an OTC broker. A criminal can therefore minimise its footprint.

The U.S. State Department recently sanctioned the OTC broker SUEX OTC. It was incorporated in the Czech Republic, with several operating offices in Russia, receiving large amounts of illicit funds from ransomware groups. The OTC broker ran a nested exchange, relying on wallet addresses and custody services provided by two larger virtual currency exchangers. About 40% of the OTC broker transactions were connected to criminal payments. Its offices in Russia allowed for cash withdrawal over the counter.

Learn more about the Cybersecurity Awareness Month on ECSM.eu.