EMI terrorist financing threat and risk gap analysis

Use our template to determine your inherent terrorist financing threats and risks and identify gaps or weaknesses in your control framework.

Terrorists often see e-money products as an easier mechanism for transferring funds or financing low-cost attacks.

As an electronic money institution, you need to understand the unique terrorist financing threats your business is exposed to and build a control framework that can enable you to grow safely without sacrificing compliance.

Use this template to analyze your business’s inherent TF threats and risks based on your customer type.

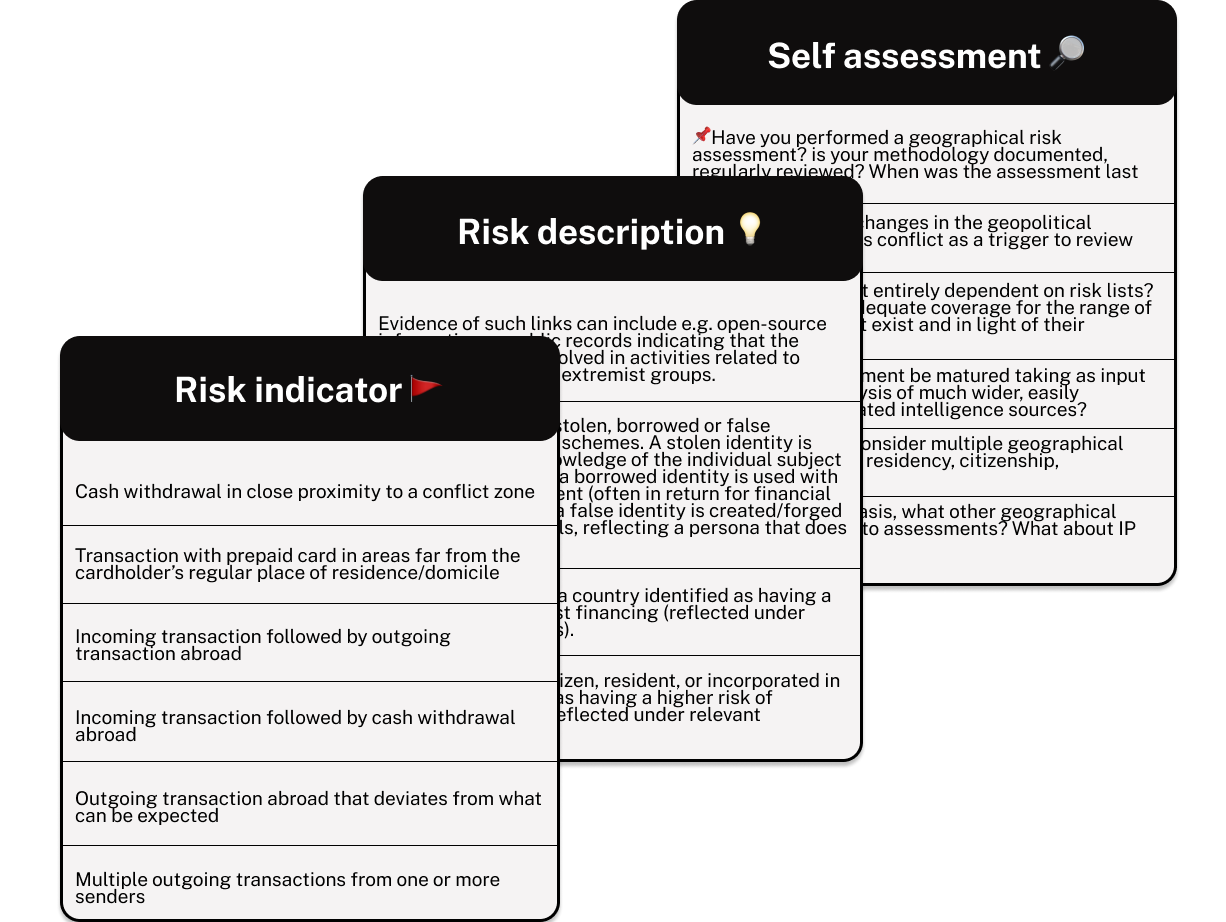

Included in the template:

- TF threats specific to EMIs and payments platforms

- 30+ risk indicators, including descriptions and their relevance to customer types

- Geographical high risk list

- Suggested self assessment questions

- References to intelligence sources

Please note, you should not consider this gap analysis as exhaustive or in any way as substituting the need for a business-wide risk assessment, as required by regulation.

The analysis in this document is limited to the needs of UK electronic money institutions (EMIs) providing e-wallets, pre-paid cards, and international payments services.